Understanding your break-even point can help you price your products, set revenue targets, and identify missing expenses. Investors will want to know at what point you stop losing money and begin to turn a profit. To create a profit and loss statement, you’ll need an account of all your income sources, including cash, check, credit and online payments your clients have made to your business. Profit margins tell you how much a company makes from selling goods and services after covering direct and indirect costs.

- Profit margins tell you how much a company makes from selling goods and services after covering direct and indirect costs.

- The cash method is common for smaller businesses that rely on cash transactions.

- You can certainly use the formula above to do so using information for specific stocks.

The accrual method records income and expenses as soon as they are earned or incurred. Using the above example, the invoice for June services would be recorded on the statement in June even though the money was not yet in the business’s bank account. Every public company is required to issue a profit and loss statement as well as a quarterly and annual balance sheet and cash-flow statement. To avoid this sort of profit ambiguity, investment returns are expressed in percentages.

Since the price is less than average cost, the firm’s profit margin is negative. It should be clear from examining the two rectangles that total revenue is less than total cost. Thus, the firm is losing money and the loss (or negative profit) will be the rose-shaded rectangle. You can calculate different types of profit margins, including net profit, gross profit, and operating profit. Gross profit looks at earnings after the cost of goods sold (COGS). On the other hand, net profit looks at profits after everything else has also been taken out, like taxes, marketing expenses, rent, and debts.

Profits and Losses with the Average Cost Curve

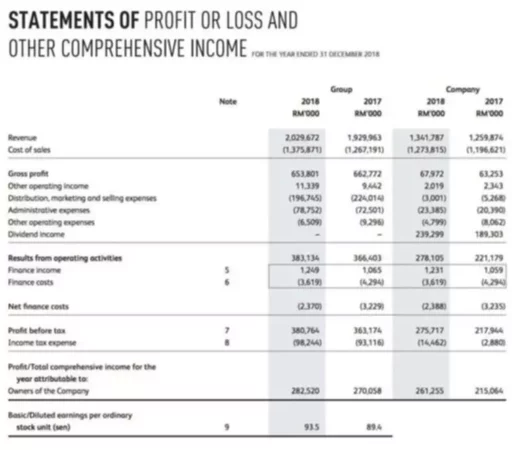

A profit and loss statement, which details all expenses and revenue over a given period, provides a big-picture look at the financial health of a company. It is one of three primary financial reports that measure a business’s success. The others are a cash flow statement, which provides a detailed look at the flow of money in a business operation, and a balance sheet, which includes factors like asset value, equity, and liabilities.

The investment in Cory’s Tequila Company was made at $10 per share and sold at $17 per share. Thus, your percentage return on your $10 per share investment is 70% ($7 gain ÷ $10 cost). For example, suppose the investor also bought 1,000 shares in Rob’s Sake Distillers at $10 apiece (for a total investment of $10,000) and later sold those shares at $10.70 each for a total of $10,700. With this trade, they would have profited by $700, yet it took 10 times the investment compared to the other example to earn it. Gains and losses are categorized by the Internal Revenue Service (IRS) as long-term and short-term gains and losses.

How Do You Calculate Gain or Loss Percentage on Stock With a Calculator?

The information can help inform strategic decisions for the next quarter or year. Once we have the P&L values, these can easily be used to calculate the margin balance available in the trading account. Currency trading offers a challenging and profitable opportunity for well-educated investors. However, it is also a risky market, and traders must always remain alert to their positions—after all, the success or failure is measured in terms of the profits and losses (P&L) on their trades.

The profit and loss statement, also called an income statement, details a company’s financial performance for a specific period of time. What counts as a “good” profit margin depends largely on the company and industry. In general, a 5% profit margin is considered fairly low — the product is expensive to produce and doesn’t generate much revenue. Finance professionals typically consider 10% profit margins healthy or average — this margin ensures profits, but you likely aren’t over-pricing your product.

A 20% margin is high, which can be great for many companies, but high profits mean you’re selling the product for significantly more than it costs to produce. This may not be sustainable as, among other things, consumers may eventually try to find a cheaper option. Operating profit is useful to know because you can use it to compare companies in states that may have different tax rates.

Want More Helpful Articles About Running a Business?

Although that may seem like a sizeable profit, it may not mean much unless they know how much they needed to invest to earn that amount of money. Here is an example of a profit and loss statement for a medical staffing company. Larger businesses that do not have to rely on readily available cash for transactions, payroll, and other expenses can use this method to accurately reflect their finances. Gains and losses are unrealized if the value changes but you hold onto the stock within your portfolio. Using this method, an investment in Rob’s Sake Distillers would yield only a 7% return ($0.70 gain ÷ $10 cost).

Profit margins are percentages that measure profitability — higher percentages mean higher profits. Net profit or net income is how much the company makes after all expenses are removed. These expenses include taxes, COGS, debts, operating costs, depreciation, and interest payments.

How To Create a Profit and Loss Statement

Here is a closer look at the different components of this financial report. For example, if a payment for an invoice from June is made in July, the statement will show the money coming in July even though the earnings are from June operations. Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. You can certainly use the formula above to do so using information for specific stocks. But there are a number of tools that investors have available to them in order to help them tabulate their returns.

Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning. Fundbox and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

- This will show the difference between Sales and Expenses As Earnings.

- All your foreign exchange trades will be marked to market in real-time.

- In (a), price intersects marginal cost above the average cost curve.

- Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics.

Explore how profit margins and other financial metrics work in real business settings with this free job simulation. It can be called an income statement, a statement of operations, and a statement of financial results and income. For example, perhaps an investor looks at your profit and loss statement and sees that your profits were limited for the quarter. If they look closely at the data, they can see whether your overall profits were limited because of uncontrolled expenses or lagging profits or because you reinvested earnings to grow your business. Here is what you need to know about to calculate profit and loss statements correctly. Profit and loss statement calculations can be complex because a business often has different expenses.

Understanding how to calculate profit margins can also help certain accountants, like certified management accountants, build budgets because they can see what areas are causing the most loss in profits. Our online tools will provide quick answers to your calculation and conversion needs. On this page, you can calculate selling price, cost price, profit percentage and net profit or loss for your sales transaction e.g., buying and selling of goods or trading in forex, stock markets. A profit and loss statement is calculated by totaling all of a business’s revenue sources and subtracting from that all the business’s expenses that are related to revenue.

It’s critical that you maintain both a cash flow statement and a P&L statement because cash and profitability are two separate indicators. Your cash flow statement provides a detailed picture of where the business’s income comes from and where it goes. If your business shows a profit but maintains a weak cash position, these two statements will give an insight as to why. In (a), price intersects marginal cost above the average cost curve.

The profit or loss is realized (realized P&L) when you close out a trade position. In case of a profit, the margin balance is increased, and in case of a loss, it is decreased. Depending on the outcome, you’ll have to determine your portfolio’s gains and losses. In this article, we help you understand some of the basics of calculating gains and losses, including some of the tools available to you. A profit and loss statement is a useful business document because it can help you analyze the financial health of your business.