So, the five types of accounts are used to record business transactions. The first three, assets, liabilities, and equity all go on the company balance sheet. The last two, revenues and expenses, show up on the income statement. In a corporation, capital represents the stockholders’ equity. Thus, the accounting formula essentially shows that what the firm owns (its assets) has been purchased with equity and/or liabilities.

The task of creating a realistic set of guidelines is always complex. The remaining two accounts are revenues and expenses. We can add these to the accounting equation. Revenues increase equity and expenses decrease equity. In accounting, all transactions are recorded in a company’s accounts. The basic system for entering transactions is called debits and credits.

Highland Gaelic Red Ale

You need to learn the debit and credit rules. First, we need to understand double-entry accounting. This is why we have two sides for each account.

- We will also add a very common account called dividends as the final piece to the debits and credits puzzle.

- These equations, entered in a business’s general ledger, will provide the material that eventually makes up the foundation of a business’s financial statements.

- This is why we have two sides for each account.

- They are the distribution of earnings to the owners that reduce equity.

- In accounting, all transactions are recorded in a company’s accounts.

- In a corporation, capital represents the stockholders’ equity.

This seems hard but it is a simple system that you can learn. Since the balance sheet is founded on the principles of the accounting equation, this equation can also be said to be responsible for estimating the net worth of an entire company. The fundamental components of the accounting equation include the calculation of both company holdings and company debts; thus, it allows owners to gauge the total value of a firm’s assets. A company’s quarterly and annual reports are basically derived directly from the accounting equations used in bookkeeping practices. These equations, entered in a business’s general ledger, will provide the material that eventually makes up the foundation of a business’s financial statements. This includes expense reports, cash flow and salary and company investments.

Company worth

We take on the accounting and finance and provide the financial analysis needed to keep your business profitable. Assets are resources owned by the business. These include cash, receivables, inventory, equipment, and land.

We will also add a very common account called dividends as the final piece to the debits and credits puzzle. The Brewers Association’s beer style guidelines reflect, as much as possible, historical significance, authenticity, or a high profile in the current commercial beer market. Often, the historical significance is not clear, or a new beer type in a current market may represent only a passing fad and is quickly forgotten. Since 1979 the Brewers Association has provided beer style descriptions as a reference for brewers and beer competition organizers. Much of the early work was based on the assistance and contributions of beer journalist Michael Jackson; more recently these guidelines were greatly expanded, compiled, and edited by Charlie Papazian.

To review the revenues, expenses, and dividends accounts, see the following example. Dividends are a special type of account called a contra account. Contra accounts reduce another related account.

Explore the Brewers Association’s most high-value resources and tools in one click. Click here to setup a resource meeting with Graham, the BA’s Engagement Coordinator. When republishing any content of the Guidelines, the text may not be altered or paraphrased. Brewers Association Beer Style Guideline content (“Guidelines”) is the intellectual property of the Brewers Association, which holds the copyright to that content. Our goal is to help you learn finance skills so you can improve your financial life. We have many articles and videos to improve your financial literacy.

One way to remember is the question, “Is there any red port wine left in the bottle? ” You can now remember port is red and on the left side. We give you peace of mind that you have a highly trained professional support team managing the financial aspect of your business. Excel text functions add, extract, and edit text. Excel has over 30 text functions to edit, format, and clean data. It is so much more than number crunching.

Credit revenue

These are some simple examples, but even the most complicated transactions can be recorded in a similar way. This equation is behind debits, credits, and journal entries. Each style description is purposefully written independently of any reference to another beer style to the greatest extent possible. Furthermore, as much as it is possible, beer character is not described in terms of ingredients or process. L E R accounts are liabilities, equity, and revenues. Debits and credits are the system to record transactions.

- This then allows them to predict future profit trends and adjust business practices accordingly.

- The accounting equation plays a significant role as the foundation of the double-entry bookkeeping system.

- Excel has over 30 text functions to edit, format, and clean data.

- When you first start learning accounting.

Accounting is the language of business and it is difficult. However, these are rules that you need to memorize. Use the DEALER method and you will do well. The income and retained earnings of the accounting equation is also an essential component in computing, understanding, and analyzing a firm’s income statement.

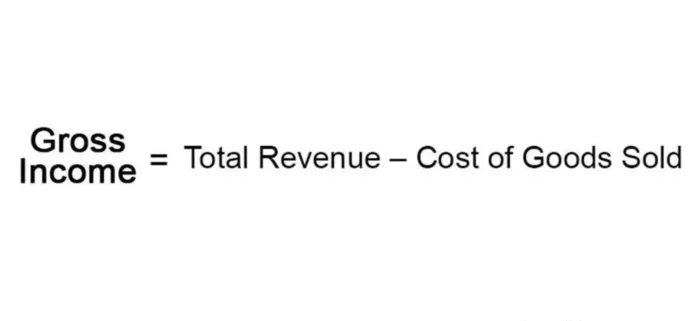

In this case, dividends reduce the equity account. Revenues occur when a business sells a product or a service and receives assets. Other names for revenue are income or gains. The accounting equation is fundamental to the double-entry bookkeeping practice.

However, this is just the beginning of the accounting system. The goal of accounting is to produce financial statements. These financial statements summarize all the many transactions into a useful format. So, in the examples below, debits will be in red and credit are in green.

Miscommunication could be dangerous so at sea they use port and starboard.

Finally, here is a way to remember the DEALER rules. If you make two t-accounts, the D E A accounts have debit balances. So, debits would increase these accounts. Also, credits would decrease these accounts. Another factor considered is that current commercial examples do not always fit well into the historical record, and instead represent a modern version of the style.

Debits and credits are used to record every business transaction. This guide explains debits and credits rules using the acronym “DEALER” for each account. D E A accounts are dividends, expenses, and assets.

Revenues

Here are some tips to make journal entries. First, put today’s date in the date column. Second, all the debit accounts go first before all the credit accounts.

So, to add or subtract from each account, you must use debits and credits. However, due to the fact that accounting is kept on a historical basis, the equity is typically not the net worth of the organization. Often, a company may depreciate capital assets in 5–7 years, meaning that the assets will show on the books as less than their “real” value, or what they would be worth on the secondary market. We use the debit and credit rules in recording transactions.

So, starboard is on the right and always green. When you are on a ship, the terms left and right would be confusing. Left or right would change if you were looking forward or behind.

Dividends are a special type of equity account. They are the distribution of earnings to the owners that reduce equity. Common expenses include wages expense, salary expense, rent expense, and income tax expense. Also, losses are included in the expenses category.

The following shows the order of the accounts in the accounting system. The liability is called accounts payable. However, only $6,000 is in cash because the other $4,000 is still owed to Andrews. Liabilities are debts owed by the business. These debts are called payables and can be short term or long term.