You record transactions as you pay bills and make deposits into your company account. It only works if your company is relatively small with a low volume of transactions. Essentially, they lay the financial foundation on which all your financial reports are generated. It would be best to have a trustworthy financial foundation to have accurate financial statements. If there are errors in your bookkeeping, there will be errors in your financial reports.

An example of an expense account is Salaries and Wages or Selling and Administrative expenses. There are several options to explore when deciding who should manage your bookkeeping. The opinions expressed in this article are not intended to replace any professional or expert accounting and/or tax advice whatsoever. You’re not in business to do bookkeeping, but you’re not in business without it, either.

To understand the financial health of your business, you need to have precise bookkeeping.

Other smaller firms may require reports only at the end of the year in preparation for doing taxes. If you use cash accounting, you record your transaction when cash changes hands. One of the first decisions you have to make when setting up your bookkeeping system is whether or not to use a cash or accrual accounting system. If you are operating a small, one-person business from home or even a larger consulting practice from a one-person office, you might want to stick with cash accounting. At the end of the appropriate time period, the accountant takes over and analyzes, reviews, interprets and reports financial information for the business firm. The accountant also prepares year-end financial statements and the proper accounts for the firm.

If the firm has taken on other investors, that is reflected here. The chart of accounts may change over time as the business grows and changes. Whether you are an independent contractor or a multinational corporation, bookkeeping is important to you. With a budget, you are better equipped to plan for future expenses. These bookkeeping tips and best practices will help your business improve its financial recordkeeping. Revenue is all the income a business receives in selling its products or services.

Bookkeeping best practices

Depending on the size of the company, quarterly reporting may be required. In some cases, this information is needed only at the end of the year for tax preparation. Bookkeeping is the process of keeping track of every financial transaction made by a business firm from the opening of the firm to the closing of the firm. Depending on the type of accounting system used by the business, each financial transaction is recorded based on supporting documentation. That documentation may be a receipt, an invoice, a purchase order, or some similar type of financial record showing that the transaction took place.

Accounts payable are usually what the business owes to its suppliers, credit cards, and bank loans. Accruals will consist of taxes owed including sales tax owed and federal, state, social security, and Medicare tax on the employees which are generally paid quarterly. Long-term liabilities have a maturity of greater than one year and include items like mortgage loans.

- Critical business decisions are made from the output of accounting records, so ensure you are hiring the best talent for your team.

- Assets also include fixed assets which are generally the plant, equipment, and land.

- You can find good resources online that can help you get started and provide tips to ensure you are doing it correctly.

- Take the stress out of managing your business’s bookkeeping, accounting, and tax prep.

- Equity is the investment a business owner, and any other investors, have in the firm.

This method is the best way to keep track of asset and liability accounts. The advantage of a double-entry accounting system is that it assures accuracy. A bookkeeper is responsible for identifying the accounts in which transactions should be recorded. A bookkeeper ensures that all financial transactions are recorded and organized for financial reporting.

The year-end reports prepared by the accountant have to adhere to the standards established by the Financial Accounting Standards Board (FASB). These rules are called Generally Accepted Accounting Principles (GAAP). Many small business owners mistake a bookkeeper for an accountant and expect more from a bookkeeper than they are qualified to do.

Determine unadjusted trial balance:

Hiring a bookkeeper who has experience in your industry will also be helpful. You want to be sure you hire a qualified bookkeeper, as bookkeeping mistakes can be costly. Ensure they have experience in your industry and a general understanding of GAAP. Expenses are all the money that is spent to run the company that is not specifically related to a product or service sold.

The information from a company’s balance sheet and income statement gives the accountant, at the end of the year, a full financial picture of the firm’s bookkeeping transactions in the accounting journal. The income statement is developed by using revenue from sales and other sources, expenses, and costs. In bookkeeping, you have to record each financial transaction in the accounting journal that falls into one of these three categories.

Bookkeeping Duties List: 17 Monthly Bookkeeping Tasks to Complete

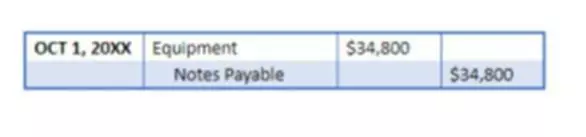

The accounting process uses the books kept by the bookkeeper to prepare the end of the year accounting statements and accounts. Very small businesses may choose a simple bookkeeping system that records each financial transaction in much the same manner as a checkbook. Businesses that have more complex financial transactions usually choose to use the double-entry accounting process. A double-entry bookkeeping system has two columns, and each transaction is located in two accounts. You enter a debit in one account and a credit in another for each transaction. For example, if your company wants to pay off a creditor, the “cash” account is reduced by the amount you owe to the creditor.

If you’re considering this route, check with other business owners for recommendations on the services they use. Equity is the investment a business owner, and any other investors, have in the firm. The equity accounts include all the claims the owners have against the company. The business owner has an investment, and it may be the only investment in the firm.

Bookkeeping consists of creating and maintaining an organization’s financial records. It involves consistently recording a company’s financial transactions, as well as the archiving and secure storage of financial documentation. When bookkeeping is handled properly, the information is accurate, well organized and helpful so that business owners or shareholders can make key financial decisions involving the company. The bookkeeping transactions can be recorded by hand in a journal or using a spreadsheet program like Microsoft Excel.

How AI Is Transforming the Accounting Industry — and What the Future Will Look Like

Liabilities are what the company owes like what they owe to their suppliers, bank and business loans, mortgages, and any other debt on the books. The liability accounts on a balance sheet include both current and long-term liabilities. Current liabilities are usually accounts payable and accruals.

About The CPA Journal

With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support. Edited by CPAs for CPAs, it aims to provide accounting and other financial professionals with the information and analysis they need to succeed in today’s business environment. When looking for a good bookkeeper, you can get referrals from your tax accountant, colleagues, and network.