Find the best finance statement templates for you and your business. With FreshBooks, you don’t need to become an accountant overnight to run your business the way it deserves. Transfer funds between your bank account and trading account with ease.

When recording the balance sheet items, there is no law on which side to record assets and the liabilities. But mostly, all assets are recorded on the left hand side be it non-current assets (also known as fixed assets), intangible assets, and current assets. It should then be noted that the reversal entry is also o key as long as no mixing of items. It is useful for constructing trend lines to examine the relative changes in the size of different accounts. According to Generally Accepted Accounting Principles (GAAP), current assets must be listed separately from liabilities. Likewise, current liabilities must be represented separately from long-term liabilities.

Enter your name and email in the form below and download the free template now! You can use the Excel file to enter the numbers for any company and gain a deeper understanding of how balance sheets work. If the shareholder’s equity is positive, then the company has enough assets to pay off its liabilities. FreshBooks provides a range of income statement and balance sheet examples to suit a variety of businesses, no matter if you have just started out or if you are looking for a different solution. This account may or may not be lumped together with the above account, Current Debt. While they may seem similar, the current portion of long-term debt is specifically the portion due within this year of a piece of debt that has a maturity of more than one year.

Identifiable intangible assets include patents, licenses, and secret formulas. In double-entry bookkeeping, the income statement and balance sheet are closely related. Double-entry bookkeeping involves making two separate entries for every business transaction recorded. One of these entries appears on the income statement and the other appears on the balance sheet. The end goal of the income statement is to show a business’s net income for a specific reporting period. If the net income is a positive number, the business reports a profit.

Common Size Balance Sheet

Any amount remaining (or exceeding) is added to (deducted from) retained earnings. About the Author – Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

In the Horizontal form of the balance sheet format, assets and liabilities are shown side by side and in the vertical form of the balance sheet, assets, and liabilities are shown vertically. A Balance Sheet is a statement showing the business’s financial position at a given time. It is the statement showing the value of assets and liabilities of a firm at a certain date. The Balance Sheet shows the report of the property owned by the enterprise and the claims of the creditors and owners against these properties.

What Goes on a Balance Sheet?

A balance sheet serves as reference documents for investors and other stakeholders to get an idea of the financial health of an organization. It enables them to compare current assets and liabilities to determine the business’s liquidity, or calculate the rate at which the company generates returns. Comparing two or more balance sheets from different points in time can also show how a business has grown. The income statement and the balance sheet report on different accounting metrics related to a business’s financial position. By getting to know the purpose of each of the reports you can better understand how they differ from one another.

The classified balance sheet format presents information about an entity’s assets, liabilities, and shareholders’ equity that is aggregated (or “classified”) into subcategories of accounts. It is the most common type of balance sheet presentation, and does a good job of consolidating a large number of individual accounts into a format that is eminently readable. Accountants should present balance sheet information in the same classification structure over multiple periods, to make the information in the periods more comparable. A balance sheet is an important reference document for investors and stakeholders for assessing a company’s financial status. This document gives detailed information about the assets and liabilities for a given time.

Comparative balance sheet

Includes non-AP obligations that are due within one year’s time or within one operating cycle for the company (whichever is longest). Notes payable may also have a long-term version, which includes notes with a maturity of more than one year. Accounts Payables, or AP, is the amount a company owes suppliers for items or services purchased on credit. As the company pays off its AP, it decreases along with an equal amount decrease to the cash account.

- One of these entries appears on the income statement and the other appears on the balance sheet.

- To have a more thorough look at how double-entry bookkeeping works, head to FreshBooks for a gallery of income statement templates.

- These sections will need to be recorded in a balanced format, meaning when an entry is inserted in one column, a corresponding entry will be made in the other column.

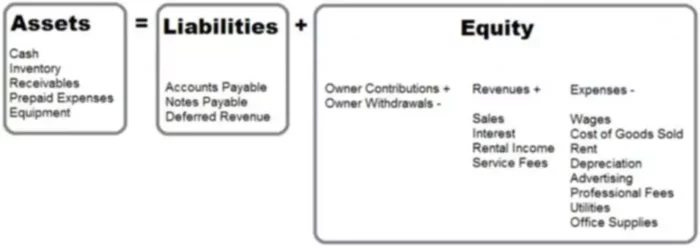

- The balance sheet equation follows the accounting equation, where assets are on one side, liabilities and shareholder’s equity are on the other side, and both sides balance out.

- As the company pays off its AP, it decreases along with an equal amount decrease to the cash account.

- Download our Desktop terminal and Mobile app Desktop terminal and Mobile app to stay on top of the FNO markets.

Property, Plant, and Equipment (also known as PP&E) capture the company’s tangible fixed assets. Some companies will class out their PP&E by the different types of assets, such as Land, Building, and various types of Equipment. The blank balance sheet template can be downloaded in a range of formats to suit your preferred software program, from Microsoft Excel and Microsoft Word to Google Docs or Google Spreadsheets. To have a more thorough look at how double-entry bookkeeping works, head to FreshBooks for a gallery of income statement templates. The balance sheet tells you what your business owns and what it owes to others on a specific date. Now that we have seen some sample balance sheets, we will describe each section of the balance sheet in detail.

Sample Balance Sheet and Income Statement for Small Business

We briefly go through commonly found line items under Current Assets, Long-Term Assets, Current Liabilities, Long-term Liabilities, and Equity. Within each of these categories, line items are presented in decreasing order of liquidity. The comparative balance sheet format presents side-by-side information about an entity’s assets, liabilities, and shareholders’ equity as of multiple points in time.

- Assets can be classified based on convertibility, physical existence, and usage.

- It should then be noted that the reversal entry is also o key as long as no mixing of items.

- Balance sheet format can be classified in to different categories based on the criteria used.

- But mostly, all assets are recorded on the left hand side be it non-current assets (also known as fixed assets), intangible assets, and current assets.

By analysing balance sheet, company owners can keep their business on a good financial footing. The balance sheet is a very important financial statement for many reasons. It can be looked at on its own and in conjunction with other statements like the income statement and cash flow statement to get a full picture of a company’s health. A balance sheet depicts many accounts, categorized under assets and liabilities. Like any other financial statement, a balance sheet will have minor variations in structure depending on the organization.

Every time a sale or expense is recorded, affecting the income statement, the assets or liabilities are affected on the balance sheet. When a business records a sale, its assets will increase or its liabilities will decrease. When a business records an expense, its assets will decrease or its liabilities will increase. The most liquid of all assets, cash, appears on the first line of the balance sheet.

Sample Balance Sheet

The total of both sides (i.e., assets and liabilities) of the balance sheet should be equal. The vertical format is also commonly referred to as T format for the structure of the financial statement looks like capital letter “T”. That is, the format has two sides, namely the right hand side and the left hand side.

In this way, the income statement and balance sheet are closely related. Balance sheets will show a more thorough overview of the security and investment health of a business, however they are both indispensable financial statements. Your balance sheet will be separated into two main sections, cash and cash equivalent assets on the one side, and liabilities and equity on the other. Documenting the financial details of your business will give you a thorough understanding of available cash flows so that you can make informed decisions about the viable future of your business. Balance sheets, like all financial statements, will have minor differences between organizations and industries. However, there are several “buckets” and line items that are almost always included in common balance sheets.