They help businesses increase conversion rates and encourage customers to buy while keeping the market rate firm. Both rebates and discounts can be effective marketing tools for businesses, but which one to prefer depends on the specific goals of the business. Selling short exposes the seller to unlimited risk since the price of the shares that must be purchased can increase by an unlimited amount. Since they require a certain amount of effort, some consumers fail to take advantage of them. Many businesses take this into account when deciding to offer a mail-in rebate.

- Many factors can make or break a business, including location, leadership, market demand, competition, etc.

- Businesses typically implement discounts in their marketing strategy to increase short-term sales, reduce out-of-date stock, and reward valuable customers.

- The manufacturer gives money to the dealer, who then transfers it to the consumer.

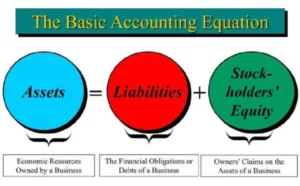

A rebate is a refund given to the buyer by the manufacturer, the distributor or the dealer. The trader is responsible for transferring $500 to the investor, or the person they borrowed the shares from to make the trade, on the trade settlement date. The borrower is liable for all losses, even if those losses are greater than the capital in the account.

The amount of the sale, before the discount is subtracted, should be reported in the gross amount column of the excise tax return. When the discount is given, the amount of the discount may be deducted in the deduction column. Discounts on retail sales are deductible under both the Retailing B&O and Retail Sales classification, when the discount is subtracted before retail sales tax is added. Discounts on wholesale sales may be deducted under the Wholesaling B&O tax classification. Enjoy great deals and expect more earnings and brilliant rewards with ZCITY!

Rebates and discounts are distinct forms of price cuts that directly or indirectly promote the overall sales of a business. Both the terms may sound similar, however, there is some difference between discount and rebate. The rebate is allowed to customers, when their purchase in quantity or in value, reaches a specified limit. The amount returned to the buyer by the seller, at the time of making complete payment for the purchases is known as a rebate. If the sale is a wholesale sale, the amount the customer is charged is subject to the Wholesaling B&O tax classification. Instant rebates come immediately after the sale — for customers that follow through with the transaction.

What is a discount?

So, in this case, the customer pays the full price of $1,200 at the time of purchase, but they will receive a $100 rebate later, effectively bringing the cost down to $1,100. While companies sometimes take a loss on a rebated product, they often find a way to squeeze out a profit on them. And even when they do take a loss, customers who purchase items with rebates may buy other items in the store, giving the business a net profit. This is a well-known sales promotion strategy and hits the demand side of any product. Rebate – It is provided by a seller to the buyer for reasons such as; inferior quality of goods, inaccurate quantity, missing buyer-specific features in the final product, delayed supply, etc. Discount and rebate are commonly used terms in today’s dynamic markets, especially in the e-commerce world.

Discounts are usually given to encourage customers to purchase more, or to reward them for loyalty. A concession is a reduction in the price of a product or service that is offered as an inducement to customers to buy from a particular supplier. Concessions are typically given for bulk purchases, or when there is intense competition among suppliers. On the other hand, discounts are more straightforward and require no additional steps from the customer. They automatically reduce the price of the product or service, making them more convenient for customers.

How are rebates taxed?

Many factors can make or break a business, including location, leadership, market demand, competition, etc. While you may think all is smooth sailing once your business launches, you still need to drive sales and enhance company loyalty. Popular strategies include offering an instant rebate for specific products or promotional discounts. A rebate is a reduction in the price of a good or service that is typically offered by the manufacturer or retailer after the purchase has been made.

If the discount is taken, the full amount of the sale should be reported under Wholesaling and a deduction for the discount should be taken on the return. For instance, a customer may be more likely to purchase a high-end camera that offers a $200 rebate than a less expensive one that has the same features and is $200 less expensive upfront. This is because the customer may feel more satisfied in the long run by knowing that they will receive a refund later. If dividends are paid during the period that the stock is borrowed, the borrower must pay the dividends to the lender. Similarly, if bonds are sold short, any interest paid on the borrowed bond must be forwarded to the lender. Reduced interest rates, by contrast, lower the monthly payments on large purchases such as vehicles.

- A Rebate is a special kind of discount that is paid to the buyer by the seller or manufacturer.

- Discounts on wholesale sales may be deducted under the Wholesaling B&O tax classification.

- In this blog post, we will explore the differences between rebates and discounts, including what they are, how they work, and when each strategy is most effective.

- In this case, a partial refund of the original amount is paid back to the customer.

- Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

Unlike rebates, there is no need to follow special instructions in order to get your money back. Since short sellers are exposed to unlimited losses, a substantial deposit is required to protect the brokerage firm from potential losses in a customer’s account. If the price of the security increases, the short seller will be asked to deposit more money to protect against larger losses. If the price continues to rise on a position, causing a larger loss, and the borrower is unable to deposit more capital, the short position will be liquidated. Discount – A seller grants it to the buyer in two distinct forms; trade discount and cash discount. It may be allowed out of the selling price (also known as maximum retail price or catalogue price) or as a reduction from the net amount payable.

What Is a Rebate?

However, discounts typically offer a smaller amount of savings, which may not be as effective at encouraging larger purchases. Businesses typically implement discounts in their marketing strategy to increase short-term sales, reduce out-of-date stock, and reward valuable customers. Thus creating better customer relationships and ensuring sale targets are met.

Rebates are typically used to incentivize customers to purchase more or to try a new product or service. They require the customer to make an additional step to claim the savings, such as filling out a form or mailing in a receipt. This extra step can make the rebate more effective at encouraging customers to make larger purchases or try new products, but it also means that it may be more complex to administer. Using discounts is a short-term, straightforward marketing strategy that is used to increase sales fast.

If they take the loss, it is -$30 per share, multiplied by 100 shares, which is -$3,000. This will be deducted from the $7,500 balance, leaving them with only $4,500, minus fees. It is difficult for individual investors to qualify for a rebate as it requires holding a substantial sum in a trading account. Generally, large institutions, market makers, and traders with broker/dealer status are beneficiaries of rebates. Some companies “price protect” certain products by offering rebates on others, hoping that sales of products with rebates will allow them to keep other products at a higher price point.

Using rebates is a long-term, often complex, sales strategy that is used to impact the size of a sale and move certain merchandise only when certain criteria are met. A rebate is a payment or refund that is paid retroactively after a purchase has been made. Often rebates are used as an incentive to purchase multiple items or more of an item at one time. This strategy can draw in customers who are interested in receiving cash back for expensive items they might not otherwise purchase. Whenever, people get a reduction in the price at the time of purchases, it is a discount, but in reality it is rebate. So, every customer and seller, must be known about the differences between discount and rebate.

Knowing in advance that only a certain proportion of customers will take the cashback, companies can estimate an average price reduction less than the rebate amount. Example of Discount – Goods worth 10,000 were sold by Unreal Corp. to ABC Corp. @10% discount each. This means a trade discount of 10% and an additional 5% discount if the payment is made within 15 days of the sale. It is a strategy used by the seller of the product to lure the customers into buying the product. Giving discounts will make the customers revisit the seller in future that in turn will benefit the seller. A discount is an amount or percentage taken off of the actual selling price.

The most common discounts are cash discounts, volume discounts and trade discounts. The original price of the laptop is $1,200, but with the rebate, the price is reduced to $1,100. To claim the rebate, the customer must complete a form and submit it to the store with proof of purchase, such as a receipt or invoice. The Federal Reserve Board’s Regulation T requires that all short sale trades must be placed in a margin account. A margin account requires the investor to deposit 150% of the value of the short sale trade.

By law, dealers must pass on the full amount of the rebate to the customer, provided the customer qualifies for it. The mail-in rebate is one of the most familiar types of consumer rebates. Rebate is refund that the seller provides to the buyer for various different reasons.

Products

That’s why it’s so important to make the right pricing decisions for your business. The rebate is also allowed to the assesses if they pay taxes more than the amount to be paid. With a discount, the customer does not have the option to receive the cash and the seller is actually taking a loss.

Some retailers will require their shoppers to mail in their rebate requests or fill out forms online. Rebates can be paid in cash or in store value and can be paid in a lump sum or in payments. A rebate cannot be given until the purchase has been completed and paid for in full. The prices you set can affect the number of sales you get, your profits, and even your brand perception.

With a rebate, the amount is given to the customer to be used as a part of the sale or to take as cash. It is facing low demand for breakfast items due to the pandemic situation. Discounts are applied at the point of purchase so that the shopper pays the discounted amount when checking out. It’s an immediate gratification for the customer and is available to all shoppers. Dealer A sells parts to a used car dealer who, in turn, uses these parts to repair vehicles for resale. Dealer A will give the used car dealer a 10% discount if the total bill is paid in full by the 10th of the following month.

For example, volume discounts (how much the cost of a product is changed based on how much is sold from your trading partner), special pricing agreements (SPAs) or claim-backs. That is why earnings or payments from instant rebate deals can form a significant proportion of a company’s profit margin. These marketing campaigns can help grow your customer base and improve sales. For a successful business, it is essential to know the difference between instant rebates and discounts, which we will explain below. Discounts and concessions are both types of price reductions, but they differ in how they are structured and applied. The amount of the discount may be fixed or variable, and it may be offered at certain times or on certain days.

It’s pretty clear that while these two strategies can get mixed up from time to time, they are very different in the way they operate and are implemented. A typical discount given by new automobile dealers is to senior citizens. With proof of their age, a percentage will be removed from the cost of repair labor and parts.

Brand Intelligence

So, for example, if an investor’s short sale totals $10,000, the required deposit is $15,000. When a short seller borrows shares to make delivery to the buyer, the seller must pay a rebate fee. This fee depends on the dollar amount of the sale and the availability of the shares in the marketplace. If the shares are difficult or expensive to borrow, the rebate fee will be higher. Businesses offer rebates for many reasons, mainly because they are a potent marketing tool, drawing customers who are attracted to the prospect of receiving cash back on expensive items. A Rebate is a special kind of discount that is paid to the buyer by the seller or manufacturer.

Discount and Rebate – a lot of confusion exists when it comes to these terms. Because the former is a lot more common, the latter is often confused with it.

A rebate is a discount given by the manufacturer of a product when the consumer purchases that product. A discount, on the other hand, is a reduction in price given by the retailer. For example, a customer who purchases a printer with a $50 rebate may simply need to fill out a short form online and submit it with their receipt to receive the refund. This can be a hassle-free way for customers to save money on their purchase. If the stock jumps overnight to $80 per share and the trader is unable to get out before that, it will cost them $8,000 to get out of that position. The trader must increase the account capital to $12,000 to keep the trade open, or exit the trade and take the loss.

In order to do that, the trader must first borrow the stock from its owner and deliver it to the buyer. When the trader places a short sale trade, the stock must be delivered to the buyer on the trade settlement date. Car shoppers are sometimes presented with a choice of a rebate or a reduced interest rate when purchasing a car. The rebate option will give the buyer more immediate cash in hand, but a lower interest rate can provide more significant savings in the long run. Digital rebate marketing also relies on paperless customer input, streamlining the rebate process. Your customers will appreciate the fast and straightforward experience, increasing the number of followers for your brand.