The amounts in each of the accounts will be reported on the company’s financial statements in detail or in summary form. One of the first decisions you have to make when setting up your bookkeeping system is whether or not to use a cash or accrual accounting system. If you are operating a small, one-person business from home or even a larger consulting practice from a one-person office, you might want to stick with cash accounting. As you dive deeper into the bookkeeping process, it may be tempting to blur the lines between your personal and business finances, but it’s not the best idea.

To determine whether errors had occurred, the bookkeeper prepared a trial balance. A trial balance is an internal report that lists 1) each account name, and 2) each account’s balance in the appropriate debit column or credit column. If the total of the debit column did not equal the total of the credit column, there was at least one error occurring somewhere between the journal entry and the trial balance. Finding the one or more errors often meant spending hours retracing the entries and postings.

Bookkeepers are responsible for recording, classifying, and organizing every financial transaction that is made through the course of business operations. The accounting process uses the books kept by the bookkeeper to prepare the end of the year accounting statements and accounts. Double-entry bookkeeping is the practice of recording transactions in at least two accounts, as a debit or credit.

Inventory

The owner’s equity account follows the amount each owner puts into the business. Small businesses are usually owned by one person or a group of partners, so there are no real stock shares to divide the ownership. All of the products your business has in stock (whether they’re sitting at the back or still sat on the shelf) need to be carefully tracked and accounted for. This part is important because the numbers you have in your books should match by doing physical counts of the inventory on hand. Expenses are all the money that is spent to run the company that is not specifically related to a product or service sold.

The business owner has an investment, and it may be the only investment in the firm. Without bookkeeping, accountants would be unable to successfully provide business owners with the insight they need to make informed financial decisions. Unlike accounting, bookkeeping zeroes in on the administrative side of a business’s financial past and present. Accounting, on the other hand, utilizes data from bookkeepers and is much more subjective. Instead, all of the money put into the business is tracked in capital accounts and money taken out appears in drawing accounts. What’s important here is that your books should carefully record all of the owners’ equity accounts.

Easy Examples of Bookkeeping for Small Businesses

An example of an expense account is Salaries and Wages or Selling and Administrative expenses. The chart of accounts lists every account the business needs and should have. If you’re unfamiliar with local and federal tax codes, doing your own bookkeeping may prove challenging.

The income statement is developed by using revenue from sales and other sources, expenses, and costs. In bookkeeping, you have to record each financial transaction in the accounting journal that falls into one of these three categories. Bookkeeping is the process of recording all financial transactions made by a business.

All of these expenses fall under the loans payable account which tracks what you owe and what’s due for you to pay. Revenue is all the income a business receives in selling its products or services. Costs, also known as the cost of goods sold, is all the money a business spends to buy or manufacture the goods or services it sells to its customers. The Purchases account on the chart of accounts tracks goods purchased. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation.

When following this method of bookkeeping, the amounts of debits recorded must match the amounts of credits recorded. This more advanced process is ideal for enterprises with accrued expenses. Very small businesses may choose a simple bookkeeping system that records each financial transaction in much the same manner as a checkbook. Businesses that have more complex financial transactions usually choose to use the double-entry accounting process. Bookkeeping (and accounting) involves the recording of a company’s financial transactions. The company’s transactions were written in the journals in date order.

On the other hand, if you have in-depth tax and finance knowledge beyond the bookkeeping basics, you may be able to get the job done. Those baby steps can help you manage your organization on a new and improved system. Small steps also give everyone time to familiarize themselves with the new bookkeeping software.

Bookkeeping (Explanation)

That documentation may be a receipt, an invoice, a purchase order, or some similar type of financial record showing that the transaction took place. Whether it’s updating your books or keeping in contact with your tax adviser, maintain your business’s financial records and expenses throughout the year. That way, you can be well prepared when it’s time to file taxes with the IRS. Without any hiccups or last-minute scrambles, you’ll be able to enter tax season confidently.

Other smaller firms may require reports only at the end of the year in preparation for doing taxes. The accounting software has been written so that every transaction must have the debit amounts equal to the credit amounts. The electronic accuracy also eliminates the errors that had occurred when amounts were manually written, rewritten and calculated. As a result, the debits will always equal the credits and the trial balance will always be in balance. No longer will hours be spent looking for errors that occurred in a manual system. Prior to computers and software, the bookkeeping for small businesses usually began by writing entries into journals.

Whether you outsource the work to a professional bookkeeper or do it yourself, you’ll be able to reap a variety of benefits. Make sure you record your sales accurately and on time so that you know where your business stands. Remember, it’s to help both your business grow and stop HMRC from kicking up a fuss.

Importance of Bookkeeping

The two key reports that bookkeepers provide are the balance sheet and the income statement. The goal of both reports is to be easy to comprehend so that all readers can grasp how well the business is doing. Accounting is the umbrella term for all processes related to recording a business’s financial transactions, whereas bookkeeping is an integral part of the accounting process. Bookkeeping is the process of tracking and recording a business’s financial transactions. These business activities are recorded based on the company’s accounting principles and supporting documentation.

- Retained earnings are cumulative, which means that they’ll appear as a running total of money you’ve maintained since your business started.

- Trying to juggle too many things at once only works to put your organization in danger.

- At the end of the appropriate time period, the accountant takes over and analyzes, reviews, interprets and reports financial information for the business firm.

- Firms also have intangible assets such as customer goodwill that may be listed on the balance sheet.

- The following four bookkeeping practices can help you stay on top of your business finances.

The purpose of closing entries is to get the balances in all of the income statement accounts (revenues, expenses) to be zero before the start of the new accounting year. The net amount of the income statement account balances would ultimately be transferred to the proprietor’s capital account or to the stockholders’ retained earnings account. Bookkeeping in a business firm is an important, but preliminary, function to the actual accounting function. When it’s finally time to audit all of your transactions, bookkeepers can produce accurate reports that give an inside look into how your company delegated its capital.

When you start to do bookkeeping for your small business, you should be aware of the different types of accounts that you need to maintain. Accounts receivable (AR) is pretty much the exact opposite of accounts payable. If you sell a product or service and you don’t collect payment immediately, then your small business has receivables which you track in this account. We get it, it always hurts a little inside when you have to spend money in your business. However, accounts payable gives you a much clearer view of everything you spend. Think of this account as one that represents the money that your business owes in the form of bills and invoices from vendors.

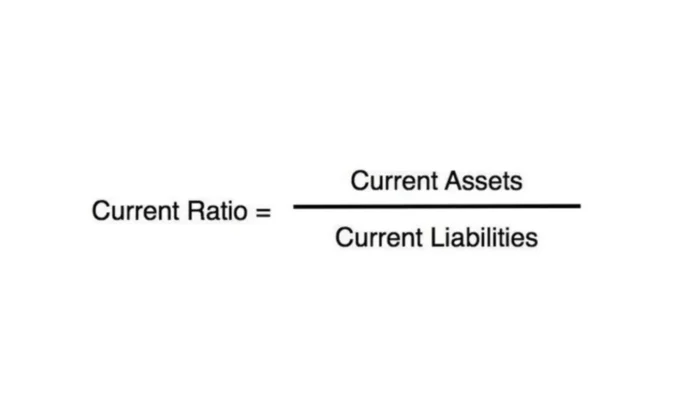

Effective bookkeeping requires an understanding of the firm’s basic accounts. These accounts and their sub-accounts make up the company’s chart of accounts. Assets, liabilities, and equity make up the accounts that compose the company’s balance sheet. Companies also have to set up their computerized accounting systems when they set up bookkeeping for their businesses. Most companies use computer software to keep track of their accounting journal with their bookkeeping entries. Larger businesses adopt more sophisticated software to keep track of their accounting journals.

Bookkeeping is just one facet of doing business and keeping accurate financial records. With well-managed bookkeeping, your business can closely monitor its financial capabilities and journey toward heightened profits, breakthrough growth, and deserved success. Bookkeeping doesn’t need to be a tedious task when you know which accounts to track and you have the right tools.

Understanding Assets, Liabilities, and Equity When Balancing the Books

A bookkeeper is responsible for identifying the accounts in which transactions should be recorded. Bookkeeping is the process of keeping track of every financial transaction made by a business firm from the opening of the firm to the closing of the firm. Depending on the type of accounting system used by the business, each financial transaction is recorded based on supporting documentation.