This means putting in a little legwork and trying to collect past due invoices before the new year. Use your balance sheet at year-end to ensure your accounts balance and everything is in order for the new year. If you find a discrepancy, make sure you find the accounting mistake and fix it. Cash flow can be positive, meaning that your business has more incoming money than expenses. Negative cash flow occurs when you spend more money than what you’re bringing in. Make sure you check these eight procedures off your year-end accounting closing checklist before the year officially comes to a close.

Reviewing these payments helps ensure that you don’t miss any due dates or overpay for something that isn’t necessary anymore. There’s nothing worse than closing out the year with a big surprise in your financial statements. One of the most common mistakes that CFOs make is not reviewing all their monthly subscriptions. This is especially important when it comes to subscription services like cloud storage providers, and more. As the fiscal year-end approaches, businesses everywhere need to gear up to properly close their accounting books. That’s where Klippa SpendControl comes in, offering a simple solution to simplify all your next year-end close pursuits.

How could your team benefit from accounting automation software?

A look at this, and you can tell when you can expect certain expenses and when you make more revenue. This is very useful in making the cash flow forecast which is essential for a positive cash flow. Draw a timeline covering all these milestones and map it to the teams involved. After all, accountants are human beings too, and errors can happen here and there.

If you really can’t collect the money yourself, consider hiring outside help. Generally, the collection agency keeps a portion of the total amount due. The more prepared a professional can be for the worst, the better off the entire process will go.

It may be necessary to adjust one of your records to make the balances equal. If your business also has an inventory where you store produced goods or raw materials, investigate that before the year-end. This is essential to not end up with expired goods or inventory shrinkage. While doing the same data processing for the whole day, they can make untraceable mistakes. One small mistake can cause hours of delay and chaos which can be hard to detect and rectify.

HighRadius Autonomous Finance Platform

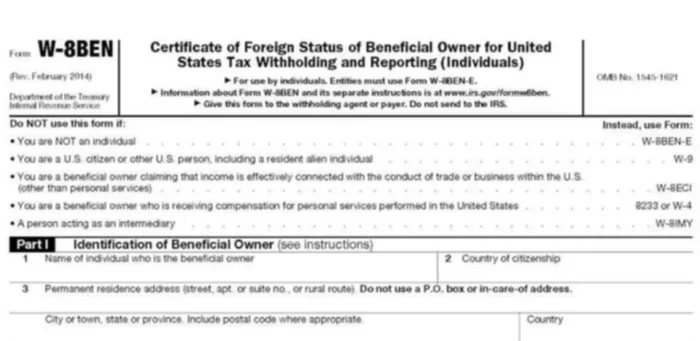

The year-end closing is also a critical step in the accounting process to make sure everything is ready for tax season next year. This is an important step in closing out your books and ensuring that they’re accurate. You’ll want to create a final balance sheet showing the company’s assets, liabilities, and equity as well as any changes that occurred during the month (such as depreciation). These are key documents that your company’s management team will use when they review results over the next few months. As well as lenders when they consider lending money to your company if needed. As the end of the year draws nearer, CFOs are getting ready for the final sprint to close one year ahead of rolling out budgets for the next.

Your income statement, or profit and loss (P&L) statement, summarizes your revenue and expenses. Your income statement lists all of the money you gained and lost throughout the year. Modern accounting technology can work wonders within your organization and when assisting clients.

- It can be scary for new business owners as they are uninformed about how to approach year-end stress.

- To make budgets and expense forecasting, these documents are the primary needs.

- For bigger companies with longer invoice terms of 3-6 months, this might be a different story, but it’s likely that there will still be a focus on expediency at the end of the year.

- By looking at this document, you can understand your revenue, expenses, taxes paid, depreciation, and many more.

- Obviously, we don’t live in a perfect world, and businesses often have to consider what they can do about their end-of-year finances when debt is on their books.

Also, go through the income, cash flow, and balance sheets prepared by the finance teams. These numbers can throw light on the financial condition of your business. Now, it’s time to reconcile your expenses by comparing payment data from different sources. Compare bank statements with invoices, bills, and receipts and review every payment made that year. Organize it based on vendors, date, month, or any other factor with neat labels.

Instead of scrambling (or forgetting) to get your year-end processes complete, use a year-end accounting checklist to organize the way you wrap up the year. The end-of-year accounting process can feel daunting for any business, including your own. Naturally, the end of the year is an excellent time to begin creating goals for the new year. Aside from carrying over any plans that have already been put in place, try making a list of goals the entire company can work towards.

Closing the books: Year-end accounting checklist to finish the year strong

The first step might be to create a roadmap that explains your firm’s policies regarding payments and how much the engagement will cost. If your firm is the right fit for the client, you need to determine how they intend to pay for your services. When these parameters are defined according to your goal, you will be able to ensure that your objectives are achievable within a certain period of time.

Ideally, this should come from the professional who handled the client’s account (or is still handling it). While this may sound like a crazy idea, getting paid any amount for the invoice is better than collecting absolutely nothing from it. Obviously, this is challenging, as you won’t always have control over whether your clients pay your bills on time (or at all). If you have invoices yet to be paid, your best bet will be to categorize them based on how likely you think a payment will be before the end of the fiscal year.

Make sure you speak to the necessary parties at the company and have them make these payments as soon as possible. The company’s profitability is determined, and so as the values of its assets, debts, expenses, and liabilities. This is conducted to ease the budget forecasting and tax filing for the upcoming year. Also, any discrepancies in accounts payable or receivable entries will be checked with the concerned team.

Analyze your accounting data and start preparing important financial statements. These documents, like cash flow statements, profit and loss, and income statements, are crucial to determining where your business stands financially. As you get a clear picture of your spending and income, you can make plans for the upcoming fiscal year. As the end of the fiscal year approaches, they’re busy finalising year-end accounting procedures and preparing financial statements. The end-of-year accounting period is a time to reflect on what you’ve done, what you plan to do, and how you can improve efficiency. It is also a momentous occasion for many companies since it marks the beginning of the next calendar year.

This means there’s no need to wait long for expenses and invoices to be processed and all steps to be completed. Instead, you can stay on top of your expenses and financial reporting at all times, enabling you to make better-informed decisions based on accurate, up-to-date information. In the next section, we will explain more in-depth how this easily adaptable expense management and invoice processing software can help simplify the year-end close process for businesses. To help simplify the year-end close, our end-of-year accounting checklist provides a comprehensive list of steps businesses should follow to minimize the stress and uncertainty around this process. Businesses must identify any adjustments that need to be made, review financial statements, and prepare for audits, which can be a time-consuming and challenging process. Overall, the year-end close process requires careful planning, organization, and dedication to ensure that everything is completed accurately and on time.

To close out the year with solid financials, look over your accounts receivable list. Double-check your accounts receivable records, as well as any outstanding invoices that may be due. If any are past due, contact vendors or customers and arrange payment terms if necessary. You can also negotiate discounts if you allow them some extra time to make their payments. This is where you’ll assign specific tasks and deadlines for everyone involved in the closing process so there’s no confusion about who does what and when. This is where using automated software tools for better spend control comes in handy.

The next section will explain why closing the financial year can become such a difficult task for accounting teams. Disorganized receipts can put your small business at risk of sloppy and inaccurate books. Not to mention, messy records can increase your chances of making errors on your business tax return and cause more issues in the future. If collecting payments from customers is difficult, consider offering them a payment plan. Plus, it shows customers that you understand their situation and care about their needs. Your business balance sheet shows your assets, liabilities, and equity and tracks your company’s financial progress.

Why is a year-end accounting checklist important?

The good news is, there are solutions available that can simplify the end-of-year accounting process and make it less daunting. This includes government contributions, special tax exemptions, and private grants, which must be properly accounted for in your financial statements. If your business has inventory, complete an inventory check before year-end.

Compare this year’s income statement to last year to analyze the differences in revenue and expenses from year to year. And, statements let you see past and current finances so you can forecast your business’s financial future and plan for the new year. You may also consider getting ahead of your accounts receivable and billing methods by following up with them in advance. Check your bills’ payment status about a week after they are sent by setting a reminder on your calendar. Likewise, simple human error can cause significant headaches for end-of-year accounting.

If you notice anything odd or discrepant, check with your accountant or the relevant team that made the spending. If you keep it a habit to reconcile frequently, you can catch any internal fraudulent activity as quickly as it happens. It takes into account every asset you own, liabilities you owe, and equity that’s left after you have paid off your liabilities. The owned assets must be equal to the liabilities and equity put together. Whether you have tens, hundreds, or thousands of employees, we’re making your business spend work for you, giving you control over spending at scale with a single solution.

HighRadius Autonomous Accounting Application consists of End-to-end Financial Close Automation, AI-powered Anomaly Detection and Account Reconciliation, and Connected Workspaces. Delivered as SaaS, our solutions seamlessly integrate bi-directionally with multiple systems including ERPs, HR, CRM, Payroll, and banks. As a business owner, your prime objective should be to tidy up the accounting tasks and make them more organized and efficient for future use.

Enjoy a fully automated and digital process for submitting, authorizing, and processing expenses using both web and mobile applications. Missing receipts and invoices – During the fiscal year, keeping track of paper receipts and supplier invoices can be a headache. However, as the year-end approaches, the pressure to conduct payment reconciliation grows stronger. Missing receipts and invoices can cause significant delays in the fiscal year-end close process and can lead to inaccurate financial statements that may bring about legal concerns. To reconcile your accounts, compare your bank and credit card statements to your accounting records. You may need to adjust one of your records for the balances to be equal (e.g., interest amounts).

- Your business balance sheet shows your assets, liabilities, and equity and tracks your company’s financial progress.

- Even with a well-built year end accounting checklist, year-end closing activities can sound scary.

- Doing this can help you when you need them in the future or for reconciliation purposes.

- Accounting and documentation fully deal with numbers and amounts which can be swapped or replaced very easily.

- Not to mention, messy records can increase your chances of making errors on your business tax return and cause more issues in the future.

Generally speaking, the younger the unpaid invoice is, the more likely you’ll be able to coerce a payment out of the client in question. At the end of the fiscal year, closing entries are used to shift the entire balance in every temporary account into retained earnings, which is a permanent account. The net amount of the balances shifted constitutes the gain or loss that the company earned during the period. Access corporate cards and other payment tools to speed up your vendor payments, expense reports, and business-related online transactions. Volopay integrates with most ERP software and automatically syncs your expense data with other connected applications. Close your accounts payable and receivable by making and receiving pending payments.

Your annual year-end accounting doesn’t have to be a complicated process. Book a demo today to find out how Payhawk can help you ensure a smooth close during this fiscal period. Accurate and automated financial management, allows companies to track and categorize their expenses throughout the year. Inefficient communication – Communication is vital during the year-end close process, but it can be challenging to keep everyone on the same page.

Create an end-of-year balance sheet and income statement

The year-end close is challenging but essential for many small and large companies. SpendControl is an all-in-one financial management solution that facilitates expense management and invoice processing automation. Klippa’s software solution is capable of optimizing and streamlining your accounting and financial processes for the year-end close.